Market Update: Moving Targets

By Michael McKeown, CFA, CPA - Chief Investment Officer

The Trump 2.0 administration is less focused on the stock market than the first term. Back then, the President said the four-year term should be measured by how well stocks do – which provided a tailwind to the market.

It seems the tune is changing this time. On two separate occasions this past week, President Trump said the economy is in “a period of transition” and warned Americans to expect “a little disturbance.” Social media posts implied he is not concerned about the recent market volatility.

This past week, Treasury Secretary Scott Bessent said there is no “Trump put” on the stock market – meaning, there is no level where the President will change course on his rhetoric. This is a change from January when tariffs on Mexico and Canada were delayed a month as equity prices fell.

It seems this administration has a different focus – and that is on the bond market. Specifically, they are pointing at the yield on 10-year Treasuries. This makes sense since the budget deficit is $2 trillion. Of this, $1.2 trillion is interest expense on the national debt, which will be increasing to $1.5 trillion as the debt is refinanced at higher interest rates. One of Bessent’s goals is to get the deficit to 3% by 2028. Today it is at 7%.

Paying the debt is not a problem (if you supply your own currency, it is impossible to run out of it). The problem is inflation. Deficits create inflation, and this can become entrenched in consumer’s minds. In turn, this keeps inflation higher, and the loop continues. The inflation that began in 2021 is still above the Fed’s 2% target and remains a concern for consumers.

In addition, bond market yields may be the ultimate goal of the cost cutting of the “Department of Government Efficiency.” Elon Musk said last month, “The bond markets do not currently reflect the savings that I’m confident we can achieve. If you’re shorting bonds, I think you’re on the wrong side of the bet.”

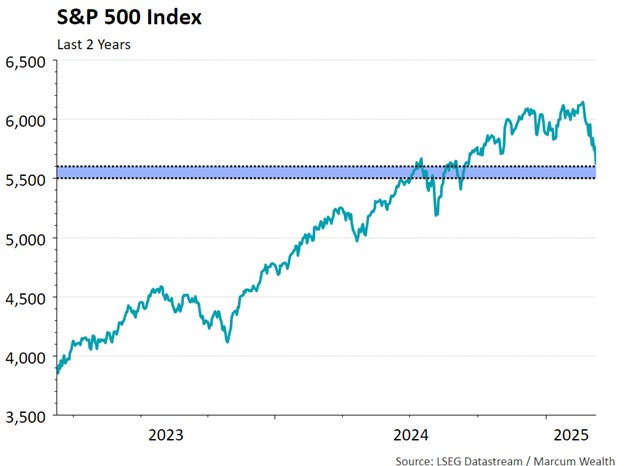

With the S&P 500 Index falling 10% from its highs, where do markets stand?

Prior highs like those seen in July and August tend to be where traders may look to dip their toe back into markets. There seems to be some indiscriminate selling as hedge fund strategies are forced out of stock positions.

The question we all want to know is, “what’s next?” Of course, no one has a crystal ball. But we can look at other markets to see how they are responding.

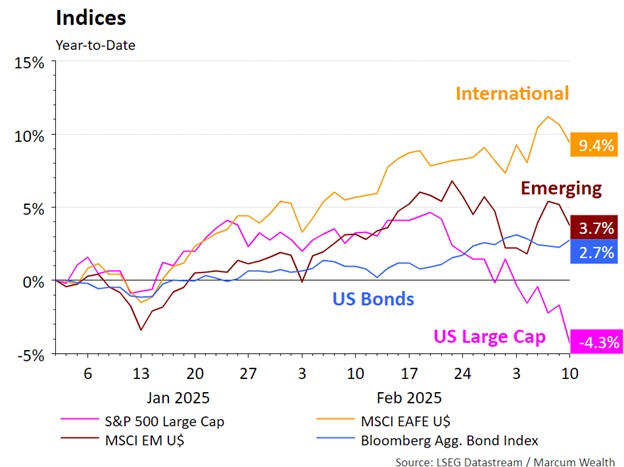

Generally, if the US economy catches a cold, the rest of the world gets the flu. Fortunately, foreign markets are shrugging off the concerns so far. Europe is opening up its purse strings for more defense spending, nearly $1 trillion from Germany, which pushed up stock prices in its financial and defense industries. Emerging markets are positive on the year as well. Bonds in the US are helping portfolios, up nearly 3% on the Aggregate Bond Index.

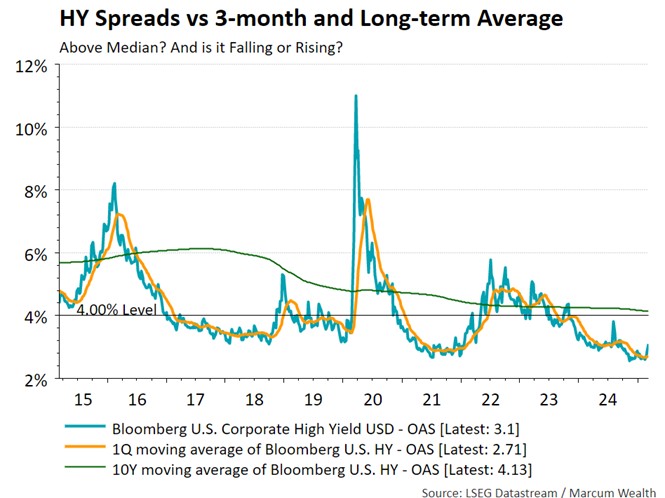

Credit markets are weaker, though high yield has not hit the target spread level that begins to price in concern (at over 4%). Meaning, spreads still have room to widen further from here.

Since the year 2000, 16 of the last 25 calendar years had intra-year price declines of 10%. Yet, 19 of those 25 years ended with positive total returns for the S&P 500 Index.

In times of heightened market volatility, it’s important to remain focused on long-term strategies and not make reactive decisions based on short-term fluctuations. While market shifts can be unsettling, our approach remains focused on maintaining diversified and well-balanced portfolios that may weather these types of challenges.

Seeing the future is impossible. Planning for the inevitable range of outcomes is not. And planning is what we do around market targets. We are ready to respond to a variety of scenarios to help our clients’ financial plans.

Important Disclosure Information

Marcum Wealth, LLC (“Marcum”) is an investment adviser registered with the United States Securities and Exchange Commission. Registration as an investment adviser does not imply a specific level of skill or training. A copy of Marcum’s current written Disclosure Brochure discussing its advisory services, fees, and material conflicts of interest is available upon request.

Past performance does not guarantee future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Marcum), or any non-investment related content, made reference to directly or indirectly in this communication, will be profitable, equal any corresponding historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Certain strategies and vehicles referenced in this communication, such as private investments, Opportunity Zones, and ESG investing, may present increased or novel risks, including potentially higher management fees, reduced liquidity, shorter performance histories, or increased legal or regulatory exposure, compared to more traditional publicly traded securities and investment strategies. All investors should consider these potential risks in light of their individual circumstances, objectives, and risk tolerance. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from Marcum. The asset allocations reflected in this communication are targets only. Actual allocations can and often will deviate from these targets, including in instances of volatile markets, large deposits or withdrawals, or during account rebalancing.

Not all services described herein will be necessary or appropriate for all clients. The scope of the services to be provided depends upon the needs of the client and the terms of the engagement. The potential value and benefit of the adviser’s services will vary based upon a variety of factors, such as the client’s investment, tax, and financial circumstances, and overall objectives. Neither personalized services nor financial or professional resources or processes should be construed as a guarantee of a particular outcome. All investing comes with risk, including risk of loss.

If you are a Marcum client, please remember that it remains your responsibility to advise Marcum, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify/advise us, in writing, to the contrary, we shall continue to provide services as we do currently. Marcum is neither a law firm, nor a certified public accounting firm, and no portion of the commentary content should be construed as legal or accounting advice. All clients are advised individualized legal, accounting, and tax advice from the qualified professional(s) of the client’s choosing. Insurance services provided by Marcum Insurance Services, LLC. The recommendation by a Marcum representative that a client engage Marcum Insurance Services for insurance-related services or products, presents a conflict of interest, as the potential receipt of revenue by Marcum’s related party may provide an incentive to recommend Marcum Insurance Services for insurance-related services or products. No client is under any obligation to engage Marcum Insurance Services for insurance-related services or products.

Certain Marcum representatives are, in their separate capacities, accounting and tax professionals of CBIZ, Inc. (“CBIZ”), an unaffiliated certified public accounting firm. Marcum does not render accounting advice or tax preparation services to its clients. Rather, to the extent that a client requires accounting advice and/or tax preparation services, Marcum, if requested, may recommend the services of a qualified tax and accounting professional, which could include recommendations to engage Marcum personnel in their separate capacity as CBIZ accounting professionals. In addition, clients of Marcum may be charged a single bundled fee for investment advisory services rendered by Marcum and accounting and/or tax preparation services rendered by the client’s engaged accounting professional. A recommendation for a client to engage a Marcum representative in their separate CBIZ capacity presents a Conflict of Interest, due to the potential receipt of tax and accounting compensation by CBIZ and/or the Marcum representative. No client is under any obligation to engage a Marcum representative through CBIZ for accounting and/or tax preparation services. Marcum will work with the accountant of the client’s choosing.