Tariffs & Global Trade Charts That Matter

By Michael McKeown, CFA, CPA - Chief Investment Officer

We recognize politics can be a difficult topic to write about. With so much on the line for economies and markets around global trading, it is necessary to explore factors that might affect portfolios in the years ahead.

Fortunately, many of President Trump’s closest economic advisors have conducted interviews and written about possible policy choices. It is like having the playbook before the game. Of course, we do not know what plays the head coach will ultimately call or how the game might shift.

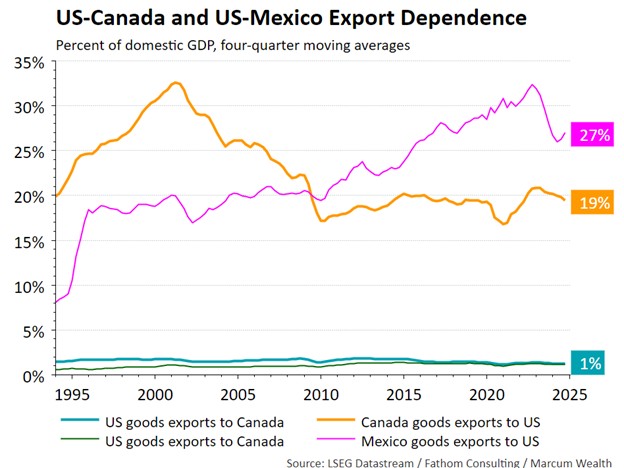

First up are Canada and Mexico. With 25% tariffs announced to begin in February, tariffs could have a big impact. Both countries export much more to the US as a percent of GDP than the US sends. For Canada, this is 19 times more, while for Mexico, it’s 27 times more.

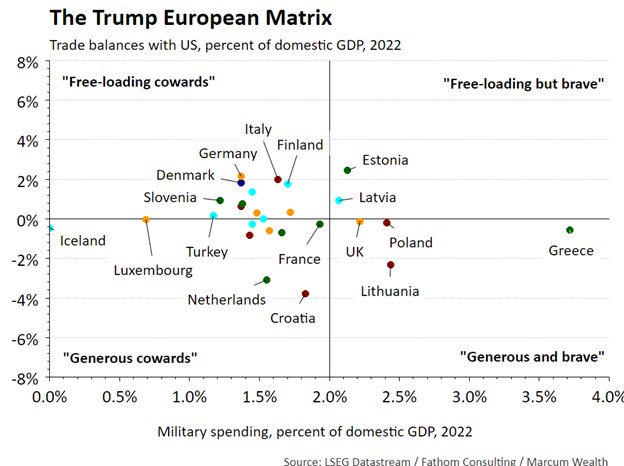

Few European countries are meeting NATO’s 2% of GDP threshold for military spending. If they are, the countries are listed on the right or “brave” side of the horizontal axis. Having a positive trade balance against the US means negotiations around tariffs are coming (which is below 0% on the vertical axis). Perhaps some of these countries can kill two birds with one stone and increase orders from US defense companies?

Or the future may bring a renaissance in industrial and defense expenditures in Europe. After slashing spending and crushing their economies in the last decade, their balance sheets are in better shape. Some countries still have massive levels of debt, but it could be worse. With threats on mainland Europe from the Russian regime, it would make sense to start to rebuild militaries. It could be the largest boost to spending in Europe in over 15 years.

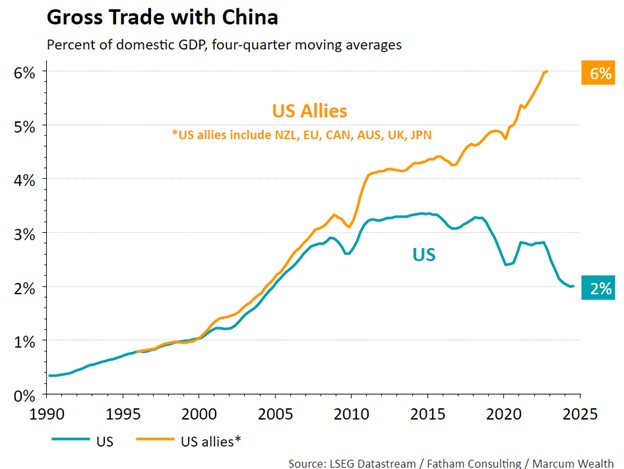

One area that Treasury Secretary Scott Bessent and Economic Advisor Stephen Miran discussed was influencing who our allies trade with going forward. Namely, are they trading with the people that are our friends, frenemies, or enemies? Over time, China has become less important to the US as a trading partner, but our closest allies have all increased. The new administration likely wants to change this trend.

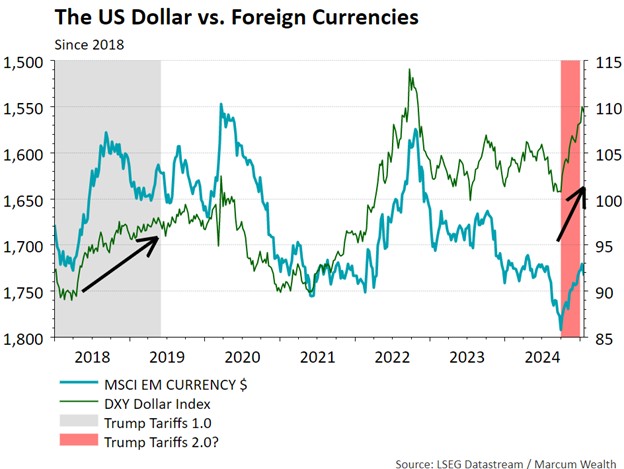

The economic advisors for President Trump are on board with using tariffs to bring countries to the table for negotiation. The potential inflation threat is one we need to think about. Though it is possible we see more of the pain go through the currency channel at first. This is what happened in the 2018-2019 period when the tariff toolkit was enacted. The dollar increased in value beginning this past October at a similar rate as early 2018.

At the end of the day, we are looking to protect and grow our capital on behalf of our clients. Currency and interest rate moves will likely affect multiple areas of portfolios over the coming year. Exploring the geopolitical events that could affect capital markets is a part of that process.

Important Disclosure Information

Marcum Wealth, LLC (“Marcum”) is an investment adviser registered with the United States Securities and Exchange Commission. Registration as an investment adviser does not imply a specific level of skill or training. A copy of Marcum’s current written Disclosure Brochure discussing its advisory services, fees, and material conflicts of interest is available upon request.

Past performance does not guarantee future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Marcum), or any non-investment related content, made reference to directly or indirectly in this communication, will be profitable, equal any corresponding historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Certain strategies and vehicles referenced in this communication, such as private investments, Opportunity Zones, and ESG investing, may present increased or novel risks, including potentially higher management fees, reduced liquidity, shorter performance histories, or increased legal or regulatory exposure, compared to more traditional publicly traded securities and investment strategies. All investors should consider these potential risks in light of their individual circumstances, objectives, and risk tolerance. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from Marcum. The asset allocations reflected in this communication are targets only. Actual allocations can and often will deviate from these targets, including in instances of volatile markets, large deposits or withdrawals, or during account rebalancing.

Not all services described herein will be necessary or appropriate for all clients. The scope of the services to be provided depends upon the needs of the client and the terms of the engagement. The potential value and benefit of the adviser’s services will vary based upon a variety of factors, such as the client’s investment, tax, and financial circumstances, and overall objectives. Neither personalized services nor financial or professional resources or processes should be construed as a guarantee of a particular outcome. All investing comes with risk, including risk of loss.

If you are a Marcum client, please remember that it remains your responsibility to advise Marcum, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify/advise us, in writing, to the contrary, we shall continue to provide services as we do currently. Marcum is neither a law firm, nor a certified public accounting firm, and no portion of the commentary content should be construed as legal or accounting advice. All clients are advised individualized legal, accounting, and tax advice from the qualified professional(s) of the client’s choosing. Insurance services provided by Marcum Insurance Services, LLC. The recommendation by a Marcum representative that a client engage Marcum Insurance Services for insurance-related services or products, presents a conflict of interest, as the potential receipt of revenue by Marcum’s related party may provide an incentive to recommend Marcum Insurance Services for insurance-related services or products. No client is under any obligation to engage Marcum Insurance Services for insurance-related services or products.

Certain Marcum representatives are, in their separate capacities, accounting and tax professionals of CBIZ, Inc. (“CBIZ”), an unaffiliated certified public accounting firm. Marcum does not render accounting advice or tax preparation services to its clients. Rather, to the extent that a client requires accounting advice and/or tax preparation services, Marcum, if requested, may recommend the services of a qualified tax and accounting professional, which could include recommendations to engage Marcum personnel in their separate capacity as CBIZ accounting professionals. In addition, clients of Marcum may be charged a single bundled fee for investment advisory services rendered by Marcum and accounting and/or tax preparation services rendered by the client’s engaged accounting professional. A recommendation for a client to engage a Marcum representative in their separate CBIZ capacity presents a Conflict of Interest, due to the potential receipt of tax and accounting compensation by CBIZ and/or the Marcum representative. No client is under any obligation to engage a Marcum representative through CBIZ for accounting and/or tax preparation services. Marcum will work with the accountant of the client’s choosing.