The Fed Shifts Gears Into 2025

By Michael McKeown, CFA, CPA - Chief Investment Officer

The last Fed Open Market Committee meeting of the year was on Wednesday. The Fed lowered interest rates another 0.25%. This marks a total of 1% in interest rate cuts over the past three meetings. This brings the Fed Funds rate to a range of 4.25% to 4.50%.

The Fed signaled they expect to pause interest rate cuts at the next meeting in January. The median projection shows a 0.50% cut in interest rates throughout 2025.

Prices remain high relative to the past few years and are a major source of economic pain. Treasury Secretary nominee Scott Bessent said, “In many ways, inflation is worse than a recession.”

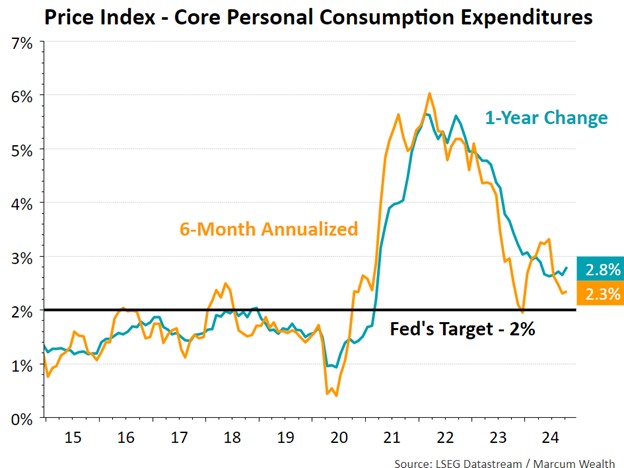

Inflation fell from its peak in 2022 but is still above the Fed’s goal of 2%. After higher data in the first quarter of this year, the data is trending in the right direction. Still, the median Fed forecaster sees core prices above the target in 2025 at 2.5%.

One major area holding up prices is housing and rent. The calculation of these metrics has them lagging real-time measures like Zillow or Apartment List would show.

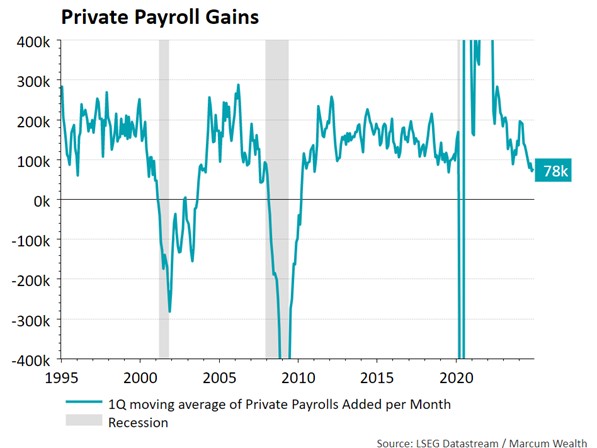

The Fed’s focus has turned to the labor market, which shows signs of slowing. Most of the gains in payrolls have come in healthcare and government jobs. Healthcare is in a secular growth trend as our population ages. Local and state government jobs have grown compared to the federal level. State and local government spending looks set to fall in 2025, so this source of jobs gains will be less.

Over the past three months, private payrolls increased by 78,000. We need to see this data increase for the economic expansion to continue. The key sectors we are watching are those that tend to see losses in economic downturns: construction and manufacturing.

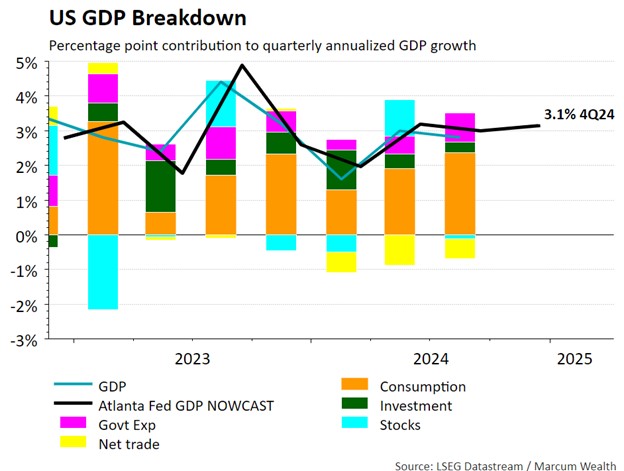

For now, the economic momentum remains solid. Corporations continue to invest. Households have strong balance sheets. Retail sales have been strong. The Atlanta Fed’s GDP projection for the fourth quarter is up 3%.

The potential policy changes in 2025 bring a degree of uncertainty. We know personal tax cuts will likely be extended. There is a potential reduction in the corporate tax rate. Both would be expansionary. On the other hand, tariffs and immigration policies may bring a contraction in economic activity in the short run. We continue to closely monitor the likely path ahead as we gain more clarity.

Important Disclosure Information

Marcum Wealth, LLC (“Marcum”) is an investment adviser registered with the United States Securities and Exchange Commission. Registration as an investment adviser does not imply a specific level of skill or training. A copy of Marcum’s current written Disclosure Brochure discussing its advisory services, fees, and material conflicts of interest is available upon request.

Past performance does not guarantee future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Marcum), or any non-investment related content, made reference to directly or indirectly in this communication, will be profitable, equal any corresponding historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Certain strategies and vehicles referenced in this communication, such as private investments, Opportunity Zones, and ESG investing, may present increased or novel risks, including potentially higher management fees, reduced liquidity, shorter performance histories, or increased legal or regulatory exposure, compared to more traditional publicly traded securities and investment strategies. All investors should consider these potential risks in light of their individual circumstances, objectives, and risk tolerance. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from Marcum. The asset allocations reflected in this communication are targets only. Actual allocations can and often will deviate from these targets, including in instances of volatile markets, large deposits or withdrawals, or during account rebalancing.

Not all services described herein will be necessary or appropriate for all clients. The scope of the services to be provided depends upon the needs of the client and the terms of the engagement. The potential value and benefit of the adviser’s services will vary based upon a variety of factors, such as the client’s investment, tax, and financial circumstances, and overall objectives. Neither personalized services nor financial or professional resources or processes should be construed as a guarantee of a particular outcome. All investing comes with risk, including risk of loss.

If you are a Marcum client, please remember that it remains your responsibility to advise Marcum, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify/advise us, in writing, to the contrary, we shall continue to provide services as we do currently. Marcum is neither a law firm, nor a certified public accounting firm, and no portion of the commentary content should be construed as legal or accounting advice. All clients are advised individualized legal, accounting, and tax advice from the qualified professional(s) of the client’s choosing. Insurance services provided by Marcum Insurance Services, LLC. The recommendation by a Marcum representative that a client engage Marcum Insurance Services for insurance-related services or products, presents a conflict of interest, as the potential receipt of revenue by Marcum’s related party may provide an incentive to recommend Marcum Insurance Services for insurance-related services or products. No client is under any obligation to engage Marcum Insurance Services for insurance-related services or products.

Certain Marcum representatives are, in their separate capacities, accounting and tax professionals of CBIZ, Inc. (“CBIZ”), an unaffiliated certified public accounting firm. Marcum does not render accounting advice or tax preparation services to its clients. Rather, to the extent that a client requires accounting advice and/or tax preparation services, Marcum, if requested, may recommend the services of a qualified tax and accounting professional, which could include recommendations to engage Marcum personnel in their separate capacity as CBIZ accounting professionals. In addition, clients of Marcum may be charged a single bundled fee for investment advisory services rendered by Marcum and accounting and/or tax preparation services rendered by the client’s engaged accounting professional. A recommendation for a client to engage a Marcum representative in their separate CBIZ capacity presents a Conflict of Interest, due to the potential receipt of tax and accounting compensation by CBIZ and/or the Marcum representative. No client is under any obligation to engage a Marcum representative through CBIZ for accounting and/or tax preparation services. Marcum will work with the accountant of the client’s choosing.