Chart of the Week

The Philadelphia Federal Reserve publishes a monthly report with a real-time snapshot of all 50 states. The 3-month rate of change shows all states growing. In October 2022, the index showed only 44% of states expanding, which typically precede an economic downturn.

Despite calls for recession since mid-2022, there has not been a sustained decline in economic activity. The pain from experiencing the highest inflation in 40 years is the likely culprit for how households and businesses feel. The long and variable lag of interest rates affecting the economy may need more time. Still, housing and larger purchases continue to surprise on the upside, even with jobless claims increasing.

What We’re Reading

Why You Believe the Things You Do – Morgan Housel

What Can the CIA Teach Investors? – Behavioral Investment

Views From the Floor – Japan in the Sun Again After Years in the Shade – Man Institute

The World’s Empty Office Buildings Have Become a Debt Time Bomb – Businessweek

Podcast of the Week

James Montier Explains Why Corporate Profits Keep Going Up – Odd Lots, Bloomberg

Last Week

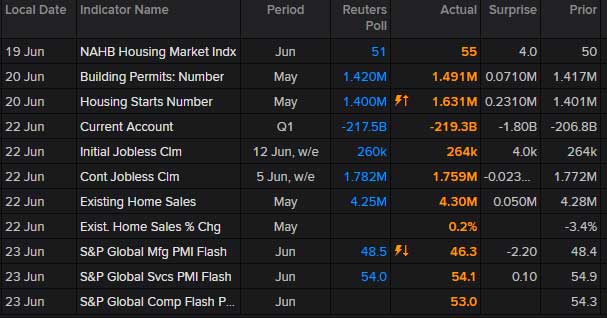

Housing was a bright spot with the National Association of Home Builders survey advancing further into expansion. Building permits and housing starts both came in above expectations. Jobless claims continue rising steadily. Services data pointed to growth while manufacturing contracted in the latest S&P survey.

The Week Ahead

Before the long holiday weekend, plenty of economic data will be released. Consumer confidence and sentiment reports will give another soft datapoint on how households feel. The price data for the Personal Consumption Expenditures Index will be a notable clue on the direction of inflation.

Thank you for reading.

Important Disclosure Information

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Marcum Wealth, or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from Marcum Wealth. Please remember to contact Marcum Wealth, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Marcum Wealth is neither a law Firm, nor a certified public accounting Firm, and no portion of the commentary content should be construed as legal or accounting advice. A copy of the Marcum Wealth’s current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request. Please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.

Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your Marcum account holdings correspond directly to any comparative indices or categories. Please Also Note: (1) performance results do not reflect the impact of taxes; (2) comparative benchmarks/indices may be more or less volatile than your Marcum accounts; and, (3) a description of each comparative benchmark/index is available upon request.